Post increased its estimate of raw milk production in 2024 due to a larger dairy cow inventory. Imports of fluid milk, whole milk powder (WMP), and skimmed milk powder (SMP) are estimated to all decline in 2024 due to higher domestic milk production. Cheese and butter imports are estimated to decline moderately because of economic headwinds that continue influencing consumption. Post estimates whey and whey product imports in 2024 to decline as demand shrinks in both food use and feed use owing to declining birth rates and a lower piglet inventory.

EXECUTIVE SUMMARY

The forecasts and revised estimates provided in this report are issued by FAS China and are not official USDA data.

Fluid milk: Post revised its 2024 estimate of raw milk production higher due to a larger dairy cow inventory. Fluid milk imports in 2024 are expected to decline due to higher domestic ultra-high temperature processing (UHT) milk production and flat domestic demand in the UHT milk market.

Whole Milk Powder: Post revised upwards its estimate of WMP production in 2024 due to higher expected volumes of raw milk production. Higher domestic WMP production is expected to result in a further decline of WMP imports in 2024.

Skim Milk Powder: Post increased its estimate of SMP production in 2024 with some minor growth from 2023. Post expects weak market demand, higher domestic WMP and SMP production and higher domestic WMP inventory to temper demand and lower SMP imports in 2024.

Cheese: Domestic cheese production in 2024 remains limited. Post revised its estimate of cheese imports in 2024 to stay at 2023 levels. Although consumption in the hotel, restaurant, and institutional (HRI) sector are expected to increase, retail sales are expected to decline.

Butter: Post lowered its estimate of butter imports in 2024 to decline from 2023 due to lower consumption.

Whey and whey products: Post estimates that imports of whey and whey products in 2024 will decline as demand in both food use and feed use will drop owing to declining birth rates and a lower piglet inventory.

FLUID MILK

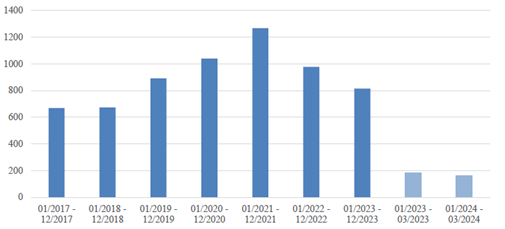

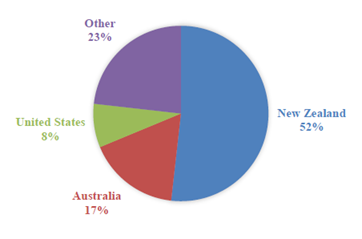

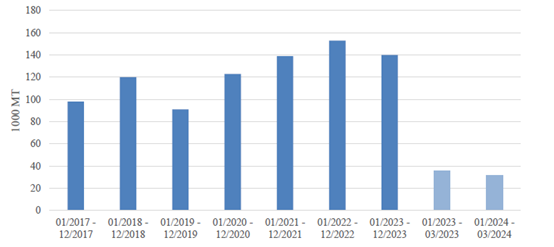

Post lowered its estimate of fluid milk imports in 2024 due to higher domestic UHT milk production and stable UHT milk consumption. In Q1 2024, fluid milk imports declined over 10 percent from the same period last year (see Chart 1).

Chart 1. China: Imports of Fluid Milk

Source: Trade Data Monitor, LLC

China mostly imports UHT milk, with a negligible amount of pasteurized milk. UHT milk is the dominant product in the Chinese fluid milk market. As raw milk in China is mainly used to produce UHT milk, domestic UHT milk dominates the market. China also imports UHT milk to supplement the market as some consumers believe in the safety and quality of imported products. In 2024, post estimates higher domestic UHT production from higher raw milk production. The UHT milk market in China has been generally stable in recent years. Given slow economic prospects, post does not expect the UHT milk market to expand significantly in 2024. This could result in domestic UHT milk products taking more market share from imported UHT milk.

The pasteurized milk market is a much smaller market and is also dominated by domestic pasteurized milk products. Industry data showed that over 99 percent of pasteurized milk is produced domestically. Imported pasteurized milk volumes will have a negligible impact on overall fluid milk imports. Additionally, industry contacts generally believe the pasteurized milk market will not see fast expansion like it did in previous years. Pasteurized milk prices are generally higher than UHT milk prices. Consumers in China will likely remain conservative on "high-end" foods such as pasteurized milk products.

WHOLE MILK POWDER

Post lowered its estimate of WMP imports in 2024 because of the large WMP supply and reported inventories. Industry sources reported a large ending inventory in 2023 of domestically produced WMP and that dairy processors continue to produce more WMP due to the oversupply of fluid milk. In the past, dairy processors preferred imported WMP that had better quality control and standard nutrition levels. According to contacts, domestic processors would not invest in improving quality control and nutritional standards in WMP production as they often lost money. Contacts shared that this often held back the domestic WMP sector and gave a preference towards imported WMP. Industry contacts, however, say that food processors are starting to accept domestic WMP as the nutritional content in domestically produced WMP is often higher than imported WMP since there are no additional steps to standardize nutritional levels in China.

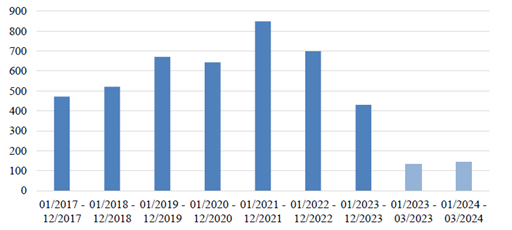

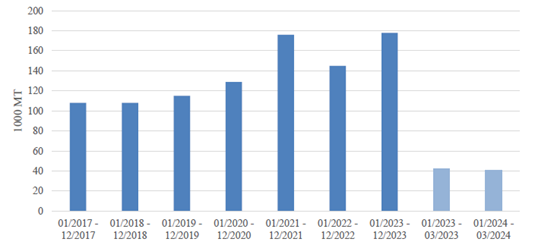

Post expects WMP imports to be lower in 2024 than 2023 due to large domestic WMP and SMP production volumes even though there were marginally greater imports of WMP in the first quarter of 2024 than in the first quarter of 2023 (see Chart 2). Industry contacts believe the higher imports in the beginning of this year are from orders made last year that just arrived and cleared customs.

Chart 2. China: Imports of WMP

Source: Trade Data Monitor, LLC

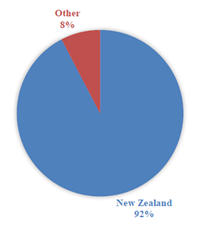

The safeguard measures for China's milk powder imports from New Zealand ended in 2023. As overall WMP imports in 2024 should decline, post estimates that imports from New Zealand will also follow the general trend. As for market share, compared to SMP imports where New Zealand still has room to grow (see SMP section), New Zealand already has over 90 percent of the market share of imported WMP through the Q1 of 2024 which was like full year 2023 data, too. (see Chart 3).

Chart 3. China: Imports of WMP in Q1 2024 (by Origin)

Source: Trade Data Monitor, LLC

SKIM MILK POWDER

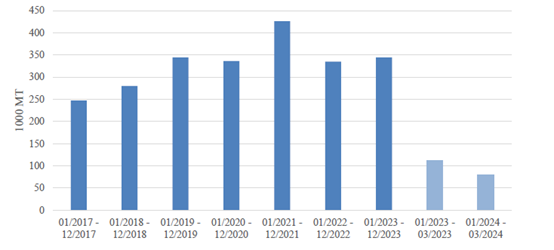

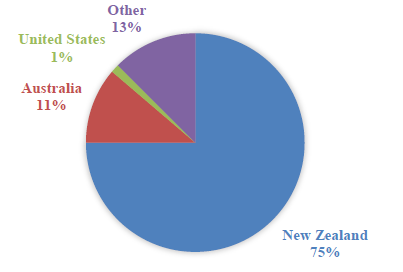

Post lowered its estimate of SMP imports in 2024. Weak market demand, higher domestic WMP and SMP production and higher domestic WMP inventory are expected to reduce demand for imported SMP. In Q1 2024, SMP imports declined YOY from 112,000 MT to 80,000 MT (see Chart 4).

Chart 4. China: SMP Imports

Source: Trade Data Monitor, LLC

As noted in the WMP trade section, 2023 was the last year for special safeguard measures on milk powder and 2024 is the year when New Zealand receives preferential tariffs with no limit for milk powder products. Post expects New Zealand’s market share will increase in comparison to other suppliers like Australia, the United States, and Finland due to the tariff-rate advantage. In YOY comparison for Q1 of 2023 and 2024, the New Zealand market share increased from 52 percent to 75 percent (see Chart 5).

Chart 5. China: Comparison between Imports of SMP in Q1 2023 & Q1 2024 (by Origin)

Q1 2023

Q1 2024

Source: Trade Data Monitor, LLC

CHEESE

Post revised its estimate for cheese imports in 2024 to be marginally lower than 2023 levels. As imported cheese is considered a high-end product in China, its market is largely influenced by economic circumstances. In Q1 2024, cheese imports showed a marginal decline (see Chart 6).

Chart 6. China: Imports of Cheese

Source: Trade Data Monitor, LLC

China imports both fresh cheese and processed cheese. Some fresh cheese is used to produce processed cheese and cheese products. As China's cheese supply mainly relies on imported cheese, consumption trends for imported cheese will be in line with general market trends: post expects market opportunities for imported cheese for the HRI sector would grow while demand in retail will decline. As sales of lollipop cheese for children in retail in decline, imported cheese used as ingredients for lollipop cheese will decline accordingly. Sources indicated that some processed cheese producers who expanded their production lines are not running at full capacity. In Q1 2024, fresh cheese imports which could also be used to produce lollipop cheese also saw decline. The decrease in cheese imports being used for further processing could be offset by cheese used in HRI as cheese consumption continues to expand in both western style cuisine and Chinese style cuisine. In Q1 2024, despite the decline of overall cheese imports, imports of grated or powdered cheese witnessed 20 percent growth.

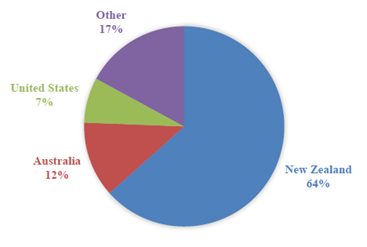

In Q1 2024, New Zealand remained the top cheese supplier, accounting for over 60 percent of the market share, followed by Australia and the United States (see Chart 7). Although the United States only accounts for a small market share, it witnessed import growth in Q1 2024. With years of education on cheese, some consumers in affluent areas have gradually developed the knowledge to differentiate between processed cheese and natural cheese and are branching into different cheese types.

Chart 7. China: Imports of Cheese in Q1 2024 (by Origin)

Source: Trade Data Monitor, LLC

BUTTER

Post lowered its estimate of butter imports in 2024 due to lower consumption. In Q1 2024, butter imports declined by almost 10 percent YOY (see Chart 8).

Chart 8. China: Imports of Butter

Source: Trade Data Monitor, LLC

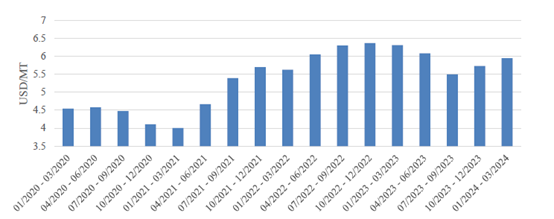

In Q1 2024, demand for products that require butter as ingredients has been weak. Imported butter prices in Q1 2024 were also lower compared to Q1 2023 (see Chart 9). Sources indicated butter suppliers are lowering sales prices to adapt to the market. However, butter prices in Q1 2024 were still at high levels compared to the last 5 years. Sources indicated that suppliers butter inventories has been at low levels which contributes to current high prices.

Chart 9. China: Imported Butter Prices

Source: Trade Data Monitor, LLC

In Q1 2024, New Zealand remained the dominant supplier in the market accounting for almost 90 percent of the market share. The volume of butter imported from the United States is negligible.

In the end of 2023 and early 2024, China opened market access to more supplying countries for dairy product exports to China. Countries that gained market access for cream and AMF include Pakistan and Austria. Post expects China's import volumes from those countries to be limited as they are not major dairy supplying countries.

WHEY AND WHEY PRODUCTS

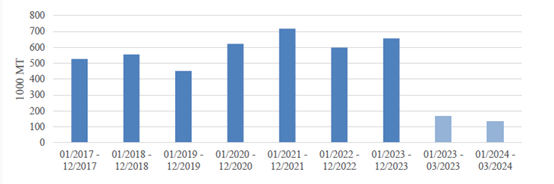

Post estimates imports of whey and whey products in 2024 to decline as demand could shrink in both food use and feed use. China is experiencing declining birth rates which moderates food use demand and a lower piglet inventory which curbs demand for feed use. In Q1 2024, imports of whey and modified whey products (HS040410) declined by over 20 percent (see Chart 10).

Chart 10. China: Imports of Whey and Modified Whey Products

Source: Trade Data Monitor, LLC

As China's whey production is minimal, the industry mainly relies on imported whey and whey-related products to meet domestic demand. Imported whey products, depending on grades, can be used as food ingredients or feed ingredients.

Industry sources indicated as food ingredients, imported whey products is used mainly in infant formula. Post forecasts that declining birth rates could continue to depress whey imports in 2024. Imported whey products can also be used in protein powder / drinks and health care products (such as supplemental foods for elderly people). As these are emerging sectors, which are relatively smaller compared to the infant formula sector, consumption of whey products in these sectors remains limited.

In feed use, whey products are mainly used in piglet feed. Losses among swine producers caused by prolonged low swine prices resulted in a reduction of inefficient sows. NBS reported that the sow inventory had declined to 41.4 million at the end of 2023. Post estimates a lower piglet inventory in 2024. For this reason, whey products consumption in feed will also decline.

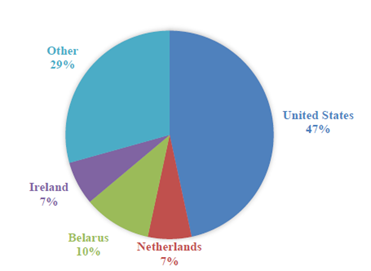

Contacts indicated most major dairy exporting countries can supply both food grade and feed grade whey products. The United States is the dominant supplier of whey and modified whey products with around half of the market share as it has competitive advantages on both quality and price (see Chart 11). Importers of U.S. whey and whey related products are eligible for tariff exclusions under the Section 301 exclusion process (see Appendix section for more information). Importers commented that they import whey products not only from the United States, but also from other countries due to concerns over bilateral issues. Still, in Q1 2024, U.S. market share remained at similar levels with previous years as overall demand from the world and from the United States was lower.

Chart 11. China: Imports of Whey and Modified Whey Products in Q1 2024 (by Origin)

Source: Trade Data Monitor, LLC

Source: USDA

Note: This article is compiled by Antion. Please indicate the source for reprint.