FAS China (Post) forecasts China's raw milk production in 2024 to remain high. However, declining raw milk prices have caused financial losses for a large number of raw milk producers and slowed the growth in production that the market experienced in previous years. Post forecasts both whole milk powder (WMP) and skim milk powder (SMP) imports to decline due to the large domestic production of raw milk and WMP. SMP imports will remain sensitive to international market prices. Post forecasts butter imports in 2024 to stay at a similar level to 2023. Higher market demand for imported fluid milk and cheese could modestly raise imports as consumers seek for high quality and affordable prices.

The forecasts and revised estimates provided in this report are issued by the FAS China and are not official USDA data.

Fluid milk: Post forecasts China's raw milk production in 2024 to remain high. However, declining raw milk prices have caused financial losses for a large number of raw milk producers and slowed the growth in production that the market experienced in previous years. Higher market demand for imported fluid milk could modestly raise imports as consumers look for high quality and affordable prices.

Whole Milk Powder: Post forecasts WMP production in 2024 to stay at similar levels to 2023 as WMP producers use excess raw milk to make WMP. Post forecasts WMP imports in 2024 to decline from weaker demand and a higher ending inventory in 2023.

Skim Milk Powder: Posts expects SMP production in 2024 to remain stable. Stable demand for SMP and sufficient carryover stocks from 2023 will push SMP imports down in 2024. Import volumes will also depend on international market prices.

Cheese: Domestic cheese production remains minimal, but Post expects China's cheese production to grow in 2024. Post forecasts cheese imports in 2024 to continue to grow but at a slower pace as growth in consumer demand for cheese is also slowing.

Butter: Post forecasts butter imports in 2024 to stay at similar levels to 2023 due to flat demand.

FLUID MILK

CONSUMPTION

Health Benefits Make Milk Consumption Stable

Post forecasts raw milk consumption to be generally stable in 2024. The price of dairy products is not as affordable as other staple foods, but Chinese consumers view dairy products as having certain health benefits worth the extra price. Although PRC news media and office contacts expect consumer purchasing power and confidence to be flat in 2024, Chinese consumers are unlikely to reduce their spending on dairy products. Industry expects that natural and healthy dairy products such as organic, low or no added sugar, additional probiotics, or from certain high-quality dairy production areas or dairy cow species will remain popular.

Fluid Use with Small Growth and Factory Use Stable

Post expects both fluid use and industrial use of raw milk to remain stable. Fluid use may have some marginal growth as it's more profitable for processors to process milk from raw milk compared to milk powder. Despite these factors, growth in consumer demand will remain limited. According to industry sources, the market for fluid milk is at an equilibrium in 2023 with retail prices peaking and started to decline slightly.

Post does not expect factory use to grow as raw milk production is flat. WMP is the major factory product of raw milk, but it’s not profitable. Usage for other dairy products, such as cheese, may grow. Due to their small volume, growth in production of other dairy products will not drive growth in overall factory use.

TRADE

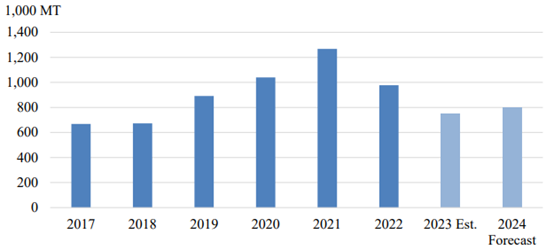

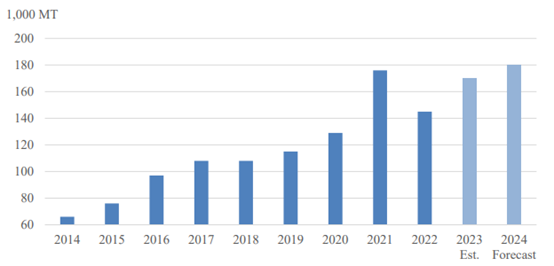

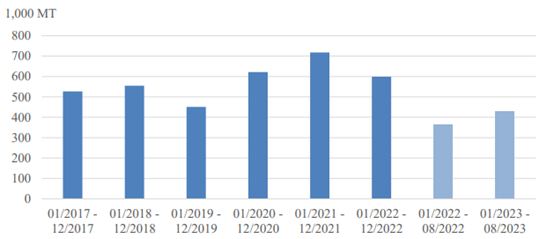

Chart 1. China: Imports of Fluid Milk

Source: Trade Data Monitor, LLC and Post Estimates

Modest Import Momentum from Market Demand

Post forecasts fluid milk imports in 2024 to moderately rebound. UHT milk is the most imported fluid milk import, and higher market demand for UHT milk will drive growth for both domestic production and imports. In China, UHT milk is the dominant product in the milk market. Consumers recognize UHT milk as having many health benefits. Families purchase UHT milk for their children and elder family members. Consumption of UHT milk is a growing trend, and imported UHT milk has better quality and price than domestically produced UHT milk.

Although consumption of fluid milk continues to grow, the growth rate will slow down in 2024 through competition from other dairy products. Consumers in affluent areas are gradually developing a preference for pasteurized milk over UHT milk. According to industry sources, the market share of pasteurized milk has grown to around 15 percent. Industry sources also indicated pasteurized milk witnessed sales growth in the first half of 2023 despite the slow economy and the weak consumer confidence. With the large production and inventory of raw milk, milk processors could easily increase production of pasteurized milk. Post expects the popularity of domestically manufactured pasteurized milk to continue in 2024, which will make it hard for the fluid milk imports to hit the peaks seen in 2020 and 2021.

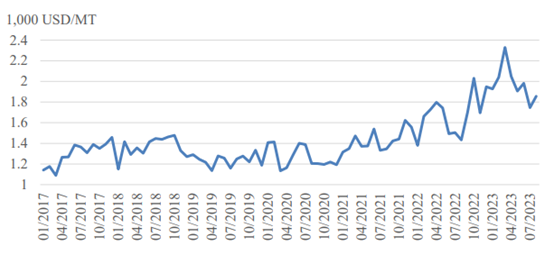

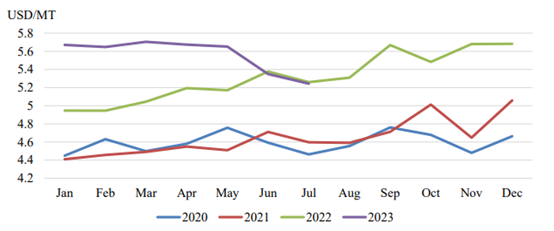

Chart 2. China: Imported Fluid Milk Prices

Source: Trade Data Monitor, LLC

Post revised the 2023 fluid milk import estimate to 750 thousand metric tons (TMT) from Post's earlier, higher estimate. In the first 8 months of 2023, imports of fluid milk products declined by over 20 percent by volume mainly due to a large domestic supply. Average prices, based on Chinese import data, rose by 25 percent (see Chart 2).

WHOLE MILK POWDER

CONSUMPTION

WMP Consumption May Decline Marginally

WMP demand has been declining in recent years among health-conscious consumers looking for additional health benefits from other dairy products. Products made from WMP, such as reconstituted milk, reconstituted yogurt and milk drinks, have become less popular especially in affluent areas. Post expects this trend to continue in 2024. However, Post forecasts WMP consumption in baked goods to remain flat as the bakery sector is relatively stable.

In the first half of 2023, WMP production outpaced consumption resulting in a high inventory of WMP. Processors who overproduce WMP tend to keep it in inventory instead of selling to the market as WMP prices are low. Post forecasts WMP inventory to decline in the second half of 2023 due to increased seasonal demand and lower seasonal production. The effective result is that Post expects 2023 yearending inventories to exceed 2022 levels.

TRADE

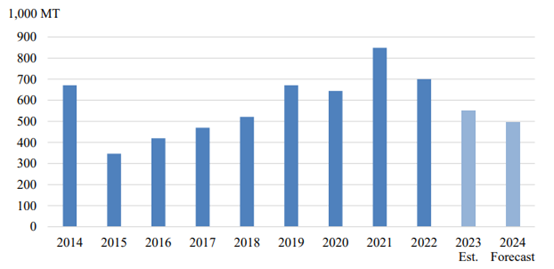

Chart 3. China: Imports of WMP

Source: Trade Data Monitor, LLC and Post Estimates

Post forecasts WMP imports to decline in 2024 because of weaker demand and ample 2023 ending inventory. Industry sources indicated that although imported WMP generally has more standardized nutrition levels, processors can benefit from domestic WMP as they can sometimes get higher protein content., Despite imported WMP prices that were generally lower than the same period last year, the import incentive hasn't been generated owing to adequate supplies (see Chart 4).

Chart 4. China: Imported WMP Prices

Source: Trade Data Monitor, LLC

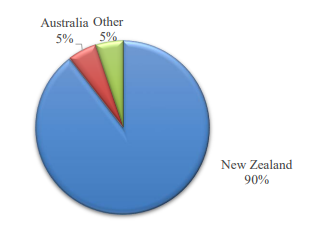

New Zealand is China's top WMP supplier, accounting for 90 percent of the market share (see Chart 5) through the first 8 months of 2023. The safeguard measures4 for milk powder imports from New Zealand will end in 2023. However, imports from New Zealand may not grow significantly in 2024 due to the expected abundancy of domestic raw milk and WMP.

Chart 5. China: Imports of WMP in the first 8 months of 2023 (by Origin)

Source: Trade Data Monitor, LLC

SKIM MILK POWDER

CONSUMPTION

Post forecasts China's 2024 SMP consumption down due to an abundance of substitute products. The main use of SMP is in food processing such as processed food, dairy beverages, and bakery products. According to industry sources, WMP and SMP are often interchangeable in food processing. As domestic raw milk remains a competitively priced option, industry sources expect food processors may choose to use more raw milk or WMP for certain products. SMP consumption also depends on international SMP prices. SMP supply mainly comes from imports as domestic SMP production is minimal. Industry members report that food processors will switch between raw milk, WMP, and SMP depending on local prices.

TRADE

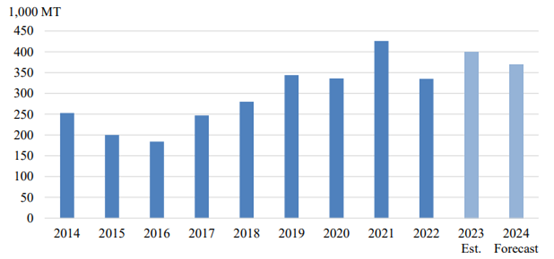

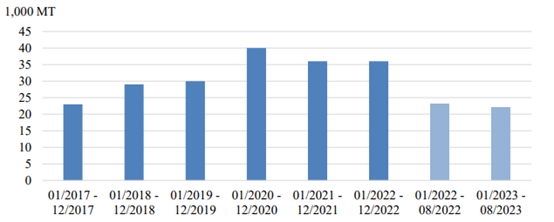

Chart 6. China: SMP Imports

Source: Trade Data Monitor, LLC and Post Estimates

Post forecasts 2024 SMP imports down as demand is stable while some 2023 inventory could carry over to 2024. There is no reliable data source for SMP inventory, but contacts indicate there will be some carry over from 2023 into 2024. Import volumes will also depend on the international market price.

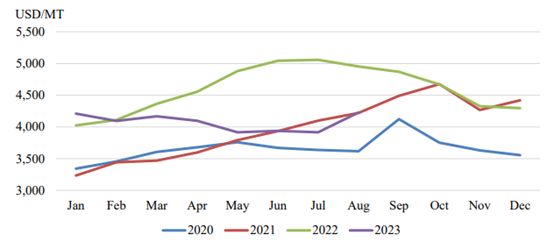

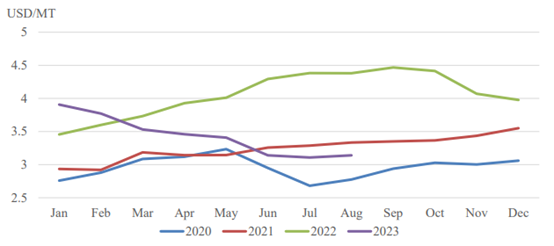

Chart 7. China: Imported SMP Prices

Source: Trade Data Monitor, LLC

Post revised the 2023 SMP import estimate up to 400 TMT. In the first 8 months of 2023, declining SMP prices (see Chart 7) led to increased imports with an almost 13 percent increase from the same period year over year. Although consumption is gradually recovering in 2023, high supply levels are expected to temper demand and lower imports are forecast in 2024.

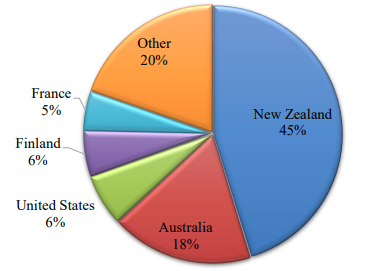

Chart 8. China: Imports of SMP in the first 8 months of 2023 (by Origin)

Source: Trade Data Monitor, LLC

New Zealand dominates the Chinese SMP import market, accounting for 45 percent of China's SMP imports, followed by Australia, the United States, Finland, and France. As noted in the WMP trade section, New Zealand receives preferential tariffs up to a certain limit for milk powder products, and 2023 is the last year for special safeguard measures on milk powder.

CHEESE

CONSUMPTION

Post forecasts cheese consumption for 2024 to further grow driven by consumer demand but at a slower pace. Challenges to and an overall slower economy could curb further growth of cheese consumption as cheese products are relatively high priced and considered a high-end dairy product.

Processed cheese dominates the Chinese cheese market. Mozzarella, cheddar, and cream cheese are popular in the Hotel, Restaurant, and Institutional (HRI) sector and in home baking, while processed cheese sticks marketed towards children dominate the retail market. These domestically produced cheeses use common food names such as mozzarella and cheddar.

In recent years, traditional supermarkets are losing popularity, and some have closed in affluent cities in southern and eastern provinces. New retail forms such as e-commerce, convenience stores, and club stores (e.g., Sam's Club) are taking over more market share. These new retail stores normally carry more cheese products which could bring more opportunities for cheese marketing to drive consumption.

TRADE

Chart 9. China: Imports of Cheese

Source: Trade Data Monitor, LLC and Post Estimates

Post forecasts cheese imports in 2024 to grow to 180 TMT (see Chart 9). China's cheese supply mainly relies on imports. A majority of imported cheeses are used to produce processed cheeses. In 2023, the number of cheese processing facilities has increased, increasing China's processed cheese production capacity. However, Post expects marginal growth in consumer demand in 2024 due to economic circumstances.

Chart 10. China: Imported Cheese Prices

Source: Trade Data Monitor, LLC

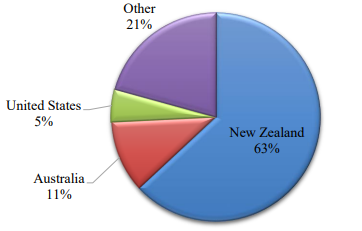

In the first 8 months of 2023, cheese imports grew by 18 percent despite declining imports of most other dairy products and higher import prices of cheese products (see Chart 10). New Zealand remained the top cheese supplier, accounting for over 63 percent of the market share, followed by Australia and the United States (see Chart 11).

Chart 11. China: Imports of Cheese in the first 8 months of 2023 (by Origin)

Source: Trade Data Monitor, LLC

BUTTER

CONSUMPTION

In 2024, Post forecasts butter consumption at the same level as 2023. Butter consumption has been growing during the past years. However, since the main use of butter is in bakery products and the food service industry, consumers will not significantly expand their use of butter to control costs due to challenges in the economy. In addition, sources report food processors will also hesitate to switch from plant-based (or artificial) butter to dairy butter due to cost concerns as dairy butter is a lot more expensive.

TRADE

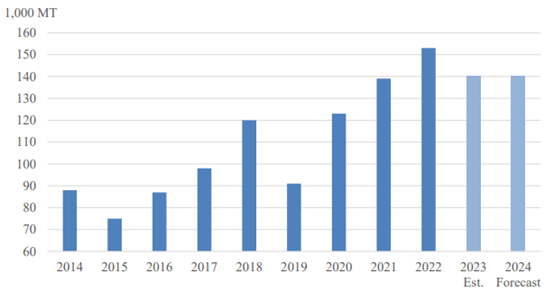

Chart 12. China: Imports of Butter

Source: Trade Data Monitor, LLC and Post Estimates

Post forecasts butter imports in 2024 to stay at the same level as 2023 (see Chart 12). China's butter supply mainly relies on imports as domestic butter production is minimal. In 2024, demand for butter will remain flat, which will limit any growth in imports. Industry expects that New Zealand will continue to dominate the market.

Butter import estimates for 2023 remains lower than 2022 given weaker demand and a high inventory. In the first 7 months of 2023, butter imports declined by 13 percent year-over-year.

WHEY AND WHEY PRODUCTS

Chart 13. China: Imports of Whey and Modified Whey Products

Source: Trade Data Monitor, LLC

The United States is the dominant supplier of both whey and whey related products. Importers of U.S. whey and whey related products are eligible for tariff exclusions under the Section 301 exclusion process.

In 2024, the declining birth rate could continue to weigh on whey imports for food use such as infant formula. However, more demand could come from the feed sector, such as a feed ingredient for piglets, depending on the expansion in the animal husbandry sector.

Chart 14. China: Imports of Whey Related Products

Source: Trade Data Monitor, LLC

Please click the link below to access the whole report.

Source: USDA

Note: This article is compiled by Antion. Please indicate the source for reprint.